New online tools let parents register check eligibility update bank info and opt out of advance monthly payments. That means that instead of receiving monthly payments of.

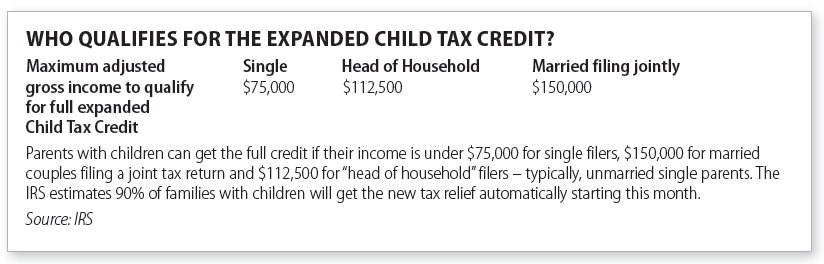

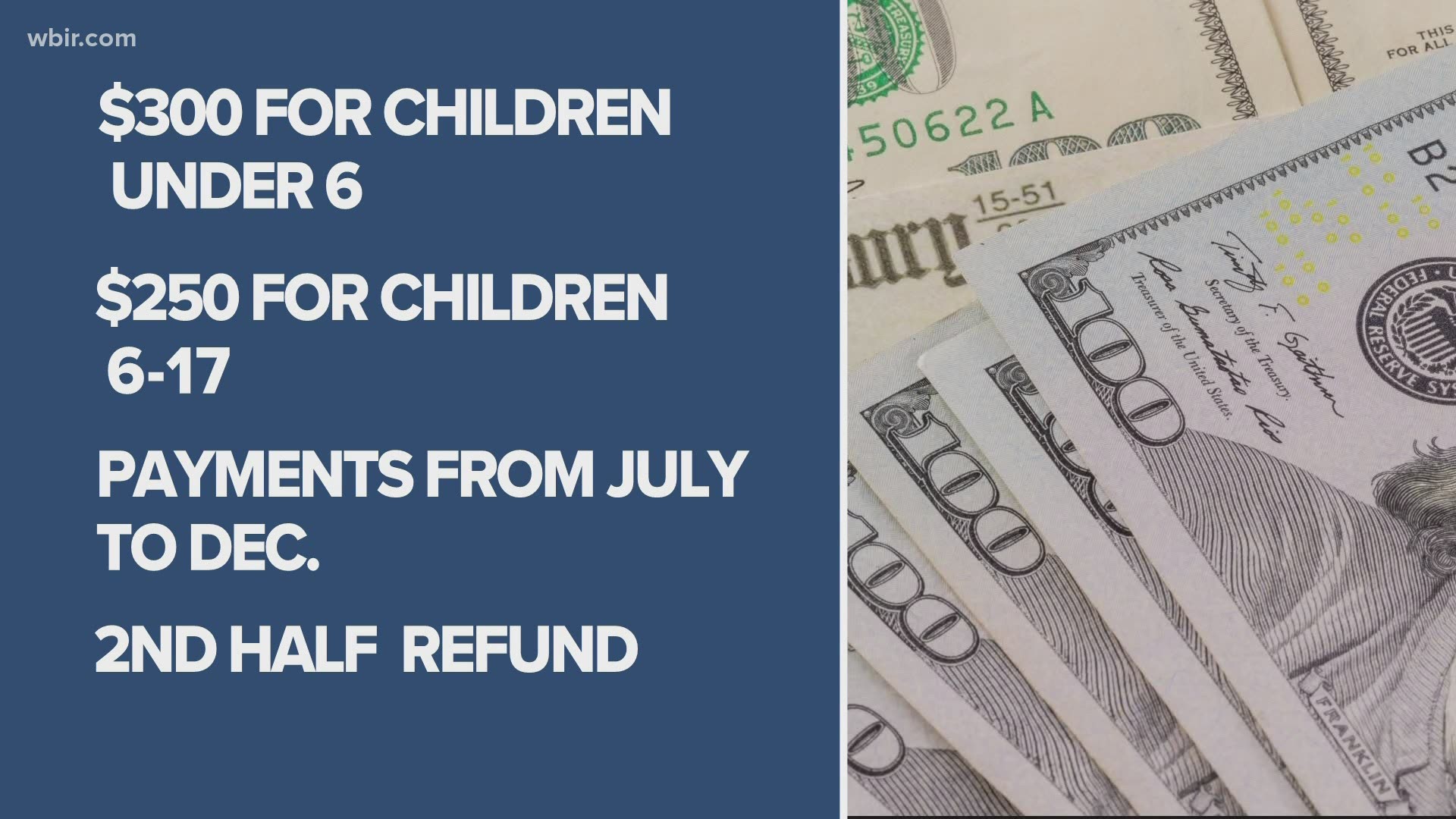

The American Rescue Plan expanded the Child Tax Credit from up to 2000 to up to 3600 per child for qualifying children.

Advance child tax credit payments portal. Important changes to the Child Tax Credit will help many families get advance payments of the credit starting this summer. On the next page sign in using your IRS. The good news is that an online portal has been created as part of the relief legislation specifically to assist with the administration of the advanced payments so parents can enter updated information and provide the agency with instructions as to who should get the tax credit or advance payments.

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The credit for qualifying children is fully refundable which means that taxpayers can benefit from the credit even if they dont have earned. Advance Child Tax Credit Payments in 2021.

Child Tax Credit Update Portal. The IRS portal that allows taxpayers to opt out of receiving advance. You will claim the other half when you file your 2021 income tax return.

If youre having or adopting a baby in 2021 dont worry -- new. Advance Child Tax Credit Eligibility Assistant. The IRS will pay half the total credit amount in advance monthly payments beginning July 15.

The latest Child Tax Credit Update Portal currently allows families to view their eligibility manage their payments and unenroll from the advance monthly payments. The advance child tax credit payments in 2021 will begin. The changes to the Child Tax Credit that were included in the American Rescue Plan will only apply to.

The credit amounts will increase for many taxpayers. How to opt out of the monthly child tax credit payments 1. Its at IRSgovchildtaxcredit2021.

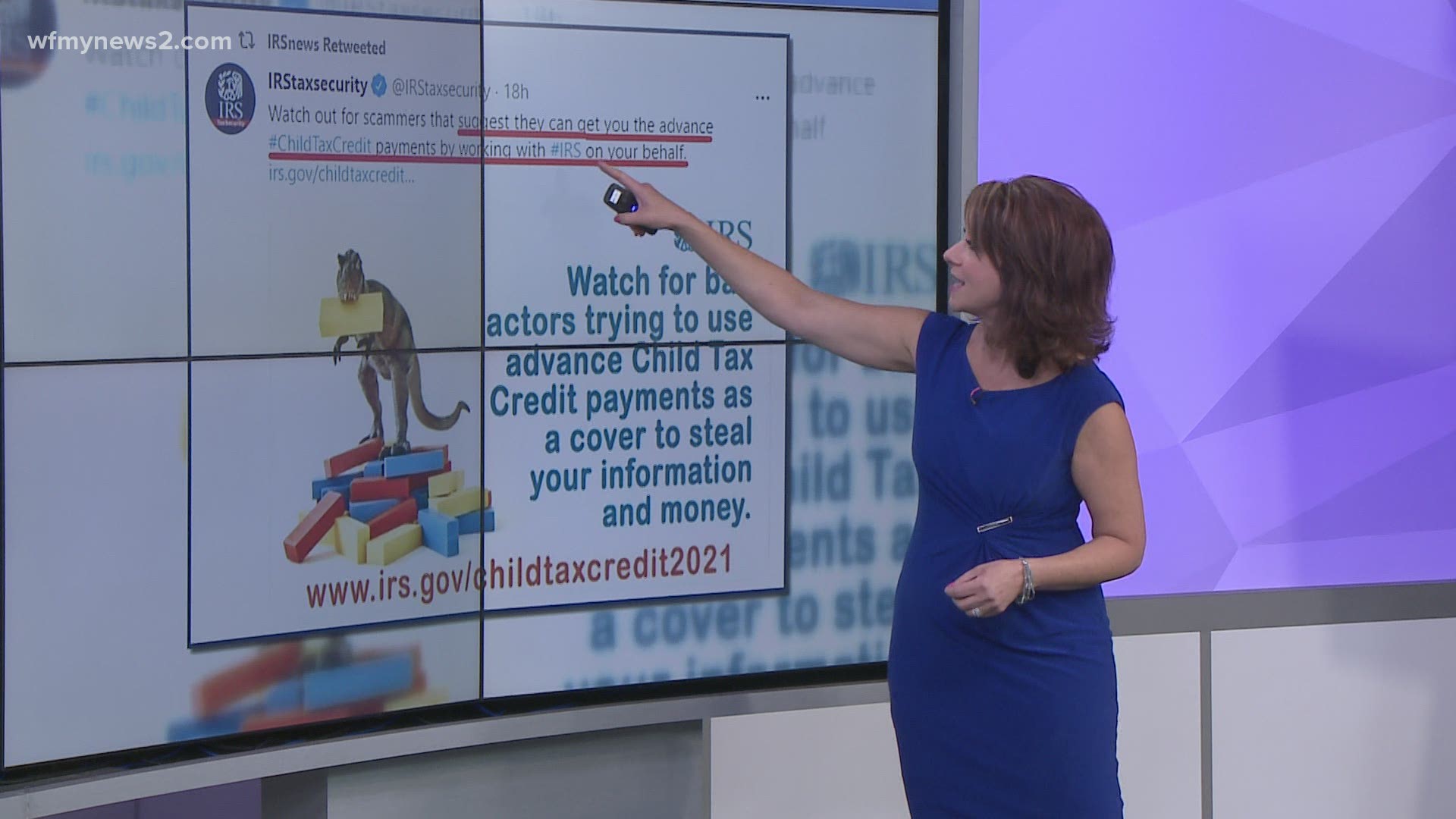

Important changes to the Child Tax Credit will help many families get advance payments of the Child Tax Credit starting in the summer of 2021. The IRS has opened an online site to enable taxpayers to unenroll from receiving advance payments of the 2021 child tax credit CTC. IRS child tax credit portals now available can help you get your payments this year.

The expanded credit means. Territories for the cost of the expanded Child Tax Credit although the advance payments of the credit dont apply. You will claim the other half when you file your 2021 income tax return.

The new Child Tax Credit Update Portal allows parents to view their eligibility view their expected CTC advance payments and if they wish to do so unenroll from receiving advance payments ie to opt out. The IRS said it will open a child tax credit portal by July 1 that will let you manage parts of your payment. The first installment of advance monthly payments begins July 15.

The enhanced child tax credit is an important part of the latest stimulus package and will impact an estimated 39 million American familiesParents can receive up to 3000 for each child aged 6 to 17 or 3600 for children under 6 and can decide if theyd like to receive half of that money through advance. The IRS has created a special Advance Child Tax Credit 2021 page designed to provide the most up-to-date information about the credit and the advance payments. Head to the new Child Tax Credit Update Portal and click the Manage Advance Payments button.

Among other things it provides direct links to the Non-Filer Sign Up Tool the Child Tax Credit Update Portal the Child Tax Credit Eligibility. The portal should allow parents to update their tax information and specify which parent should receive the advanced payments so that one parent is not getting the tax credit two years in a. Starting on July 15 monthly payments will start rolling out to millions of American families under the expanded child tax credit.

The IRS will pay half the total credit amount in advance monthly payments. The new law provides for payments to US. For tax years after 2021 residents of Puerto Rico would be able to claim the refundable portion of the child tax credit even if they dont have three or more qualifying children.

The American Rescue Plan Act of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. The Child Tax Credit Update Portal now lets you opt out of receiving the monthly child tax credit payments. The advance payments are designed to provide parents with financial stability.

2021 Child Tax Credit Advance Payment Option. The latest Child Tax Credit Update Portal currently allows families to view their eligibility manage their payments and unenroll from the advance monthly payments. Half the total credit amount will be paid in advance monthly payments and you will claim the other half when you file your 2021 income tax return.

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Child Tax Credit Faq What To Know Before Your First Payment In 5 Days Cnet

New 3 000 Child Tax Credit Payments To Start In July See If You Re Eligible Wfla

Know How To Login Into Income Tax Portal Income Tax Income Tax

Irs Unveils Tool To Opt Out Of Monthly Child Tax Credit Payments

Child Tax Credit Opt Out When Is The Deadline Kxan Austin

Next Week S Child Tax Credit 3 Quick Ways To Know If You Qualify Cnet

How Do I Manage The Child Tax Credit Monthly Payment 9news Com

Pin By Financialfamefm On Gst Financial Markets Stock Market Paying Taxes

Child Tax Credit You Can Opt Out Of Monthly Payment Soon Wqad Com

Why You May Want To Opt Out Of The Monthly Child Credit Tax Payments

Payment Process Penalties Calculation Of Advance Tax Tax Payment Tax Income Tax

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Child Tax Credit Dates Ages Qualifications Eligibility And Everything You Need To Know Marca

3 Quick Ways To See If You Re Eligible For The July 15 Child Tax Credit Payment Cnet